Keeping track of your budget, whether a personal or business, is a bore, but also a necessity. If you don’t know how much you’re spending then you can find yourself in a heap of trouble very soon.

Here are five of the best ways to track your small biz finances online in real-time.

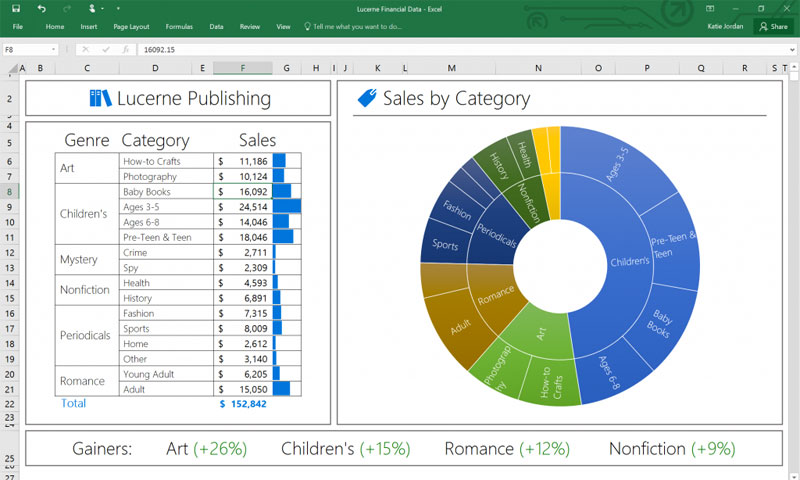

1. Excel

For the top of our list, we need to take a look at something simple and familiar. We are, or course, talking about good old Microsoft Excel. By making a budget template on your own, you get a simple and frugal way of updating your current financial standings.

The best part of Excel? It’s free. The second best part? You already know how to use it.

But of course the greatest downside of using Excel is that nothing is automated. So you have to manually input all expenses, being diligent to update the spreadsheet frequently as expenses arise.

2. BudgetTracker

![]()

Another great software for tracking your budget manually is BudgetTracker. Like Excel, this software requires you to manually input your income and expenses, but it does make your life easier by helping you get a detailed tracking of spending and budgeting.

Unfortunately, at the moment, there is no way of linking data from your bank account in order to automate at least one part of the process.

Seeing how it constantly requires your intervention, this particular software requires you to invest more interest into your company’s finances.

3. TheExpenseTracker

![]()

This particular software has the thing that previous two entries on this list desperately lacked – full automation of your budget tracking process. What this incredible tool does is it connects with your credit cards, phone and email. This way, any purchase that comes through some of these channels gets automatically updated.

You get a tool for real-time tracking of all your company’s expenses, which, frankly, gives you a much better picture of what you’re up against. Unfortunately, the cost of this app is $19.95 per month, which is a bit more than some of its counterparts are charging. Still, people who went on and tested the tool claim that it is worth the money.

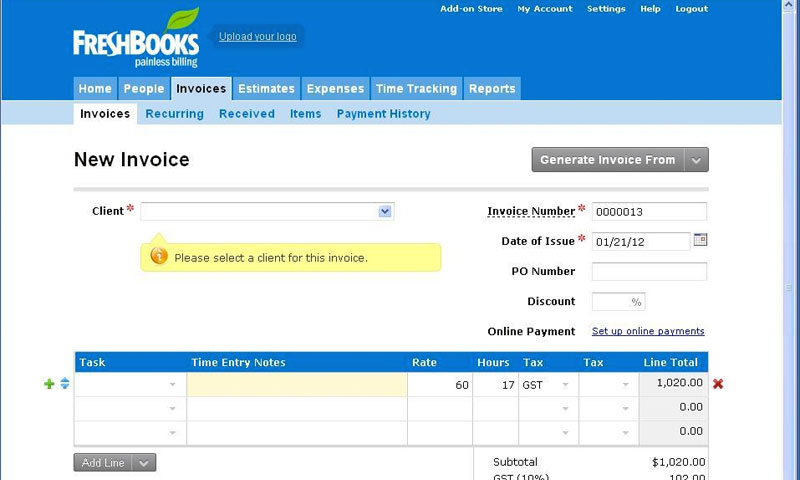

4. Freshbooks

Small biz owners need all the help they can get, and Freshbooks looks to provide you with a simple way to create and track invoices. If you need to invoice clients, Freshbooks lets you create professional looking invoices and bill clients with recurring invoices.

You can also create customizable reports such as profit and loss statements, which are helpful to provide to your tax preparer, or if you decide to efile for free.

This app starts at $15 per month for small businesses.

5. Quickbooks

Quickbooks by Intuit is the priciest on the list, but it’s also the best. With QuickBooks you can keep everything organized in one centralized place. You can connect your bank account to automatically import expenses and categorize them. You can also take pictures of your receipts with QuickBooks Mobile.

It’s much more than just an expense tracker though, as it has invoicing features with custom reminders and tracking. Plus, you can always see custom reports to see where your business stands at any given time.

Conclusion

As you can see, this list offers something for everyone. Those who put frugality above everything else (which is understandable, seeing how it’s your company’s finances we are talking about) can do all of this in Excel. On the other hand, some people are of the attitude that time is money. For them, saving time on making these entries and avoiding the risk of missing something, are more than worth a moderate fee.

Overall, it would be absurd to claim one tool to be clearly superior to others. Remember, there is no such thing as a perfect method; only a perfect method for your company.